Is Malaysia’s Pension Scheme Sufficient to Secure the Quality of

Life for the Elderly?

Isahaque Ali, Universiti Sains

Malaysia, Malaysia

Azlinda

Azman, Universiti Sains Malaysia, Malaysia

Zulkarnain

A. Hatta, Lincoln University College, Malaysia

M. Rezaul

Islam, University of Dhaka, Bangladesh

A H M

Belayeth Hussain, Universiti Sains Malaysia

(USM), Malaysia

1

Introduction

The present pension system has created

concerns among employers, academics, social development scholar and

policymakers in Malaysia and other countries (Ju, Han, Lee, Lee, Choi, Hyun,

& Park, 2017). In 2017, the population in Malaysia was estimated at 32

million. The portion of that population aged 0-14 years in 2017 dropped to

24.1% from 24.5% in 2016 and the number has increased among those aged 15-64

years from 69.5% in 2016 to 69.7% in 2017 (Department of Statistics Malaysia,

2017). Currently, the elderly population constitute 8.2% (2.4 million) of the

total population, and this figure is expected to increase to 15% by the year

2030 (Yahaya, Abdullah, Momtaz, & Hamid, 2010; Wan-Ibrahim & Zainab,

2014; Onunkwor et al., 2016). This indicates that the elderly population will

present a significant challenge for Malaysia (Tolos, 2012).

The current pension provision and its

ability to provide income and financial sustainability for a significant number

of the elderly in Malaysia is an issue of concern (Onunkwor, Al-Dubai, George,

Arokiasamy, Yadav, Barua, & Shuaibu, 2016). Malaysia has several social

protection systems including the public pension scheme offered only to civil

servants, the Employees Provident Fund (EPF) for the private sector, Social Security

Organisation (SOCSO) and the Armed Forces Superannuation Fund (Tolos, 2012). It

is predicted that the pension of civil servants, EPF and old age assistance

will not be sufficient to fulfil the additional demands of the elderly. The

issue is exacerbated by longer life expectancy and the increasing cost of

securing a comfortable living in Malaysia (Barr & Diamond, 2009; Yusuf,

2012; Chen, Hicks, & While, 2014; Mohd, Mansor, Awang, & Ahmad, 2015;

Awang & Ahmad, 2015; Onunkwor et al., 2016). It is assumed that the

existing pension system covers only a small portion (around 11%) of the total

elderly population in Malaysia (Park & Estrada, 2012; Tey, Siraj,

Kamaruzzaman, Chin, Tan, Sinnappan, & Müller, 2016). This trend will

further increase the risk of poverty (Doling & Omar, 2012) among the

elderly.

Despite efforts by the Malaysian

government to achieve zero poverty, the issue of poverty among the elderly is a

relatively new concern. Additionally, the majority of Malaysians do not have

social pension (also known as a non-contributory pension) and social protection

in old age (Hatta & Ali, 2013; Ong & Hamid, 2010; Mohd et al., 2015).

In Malaysia, the compulsory retirement age is 60 years. However, many older

adults continue working (paid work, contract job) (Ng & Hamid, 2013) after

retirement to supplement their income (Masud et al., 2006b). This trend will

create tensions in the job market that would affect the young generations

seeking to enter the job market adversely.

Another challenge faced by older Malaysians

is the inadequacy of their savings upon retirement. Generally, elderly

Malaysians have limited savings, especially the 40% of households with a very

low average monthly household income of RM 1,440 (US$ 351.21) (Samad &

Mansor, 2013). In Malaysia, 22.7% of the households headed by the elderly (aged

65 years and over) had the highest incidence of poverty (Hatta & Ali, 2013;

Sharifah et al., 2010). Therefore, an effective and vigorous public and private

pension system for the “target population” is an important tool for adequate

old-age income (Park & Estrada, 2012).

In the global context, the social pension

system contributes significantly to the financial security of the pensioners

and has a positive impact on social development. However, the pension in developing

countries is inadequate for large numbers of pensioners to secure them against

poverty (Barrientos, 2009). The current global economic downturn has affected

the economies of many developing countries like Malaysia and has affected the

pension system. For example, the government of Malaysia reduced the

contribution rates for retirement savings for employees in 2009 to stimulate

the demand for consumption and labour (Yusuf, 2012). A large number of retirees

are at the risk of poverty and experienced a reduction in income due to limited

income sources and dependents (Vaghefi, Kari, & Talib, 2016; Tolos, 2012).

Therefore, the government of Malaysia must focus attention to revising the

public pension system in order to improve the effectiveness of the pension and

maintain the QOL of pensioners (Yusuf, 2012). Hence, this study seeks to

examine whether the public pension system provides sufficient value to ensure a

standard QOL in later life in Malaysia.

2

Literature Review: Concepts, Theories and

Research

2.1 Quality of life

(QOL) of the elderly

The World Health Organisation (WHO)

defined QOL as individuals’ perception of their position in life in the context

of the culture and value systems in which they live and in relation to their

goals, expectations, standards and concerns (The WHOQOL Group, 1998). The

WHOQOL Group emphasises “the importance to know how satisfied or bothered

people are by important aspects of their life, and this interpretation will be

a highly individual matter” (Skevington et al., 2004, p. 299). The QOL

construct has a complex composition, so it is perhaps not surprising that there

is neither an agreed definition nor a standard form of measurement (Cummins,

1997; Marans, 2015). On the other hand, quantifying QOL faces numerous debates,

for example: What aspects should be measured and what is the relative weight of

different aspects? (Veenhoven, 2007).The WHOQOL-BREF is currently scored in

four domains: physical health, psychological, social relation and environment

(Skevington et al., 2004). Nevertheless, the QOL includes good physical

functioning, relationships with others, psychological well-being, health, and

social activity as critical aspects of well-being for the elderly (Alavi et

al., 2011).

The QOL comprises eight domains including

interpersonal relation, material well-being, social inclusion, physical

well-being, personal development, emotional well-being, self-determination and

rights (Schalock, 2004). It is a vast concept that covers a person’s

psychological state, physical health, social relationships, level of

independence and relationships with salient features of his or her atmosphere

(Bodur & Cingil, 2009). Employment, housing, income, social security,

marital status, education, and other living and environmental circumstances

affected the QOL (Smith, Sim, Scharf, & Phillipson, 2004). Many

organisations and countries have defined QOL differently, resulting in no

agreed definition or standard measurement. These attempts have used different

characteristics to measure QOL (Gou, Xie, Lu, & Khoshbakh, 2018). For

example, Zhao, Heath and Forgue (2005) measured the QOL by income, good health;

healthcare facilities, housing, psychological variables such as happiness and

satisfaction with life and work.

This study used the QOL scale developed by

Zhao, Heath and Forgue (2005) and the QOL defined by the WHO, which is

consistent with Western society. In Asia, the QOL Index was developed by the

Faculty of Social Science, The Chinese University of Hong Kong. This index

covers a wide range of life domains, which consists of 23 indicators that are

grouped into five sub-indices: Health, Social, Culture and Leisure, Economic

and Environmental (Chan, Andy Kwan, & Daniel Shek, 2005). The indicators

are selected according to the coverage, measurability, representativeness, and

importance to the QOL in Hong Kong. A higher score indicates better QOL (Gou et

al., 2018).

In Malaysia, QOL was defined as the

progress achieved when a society shifts from an unfortunate state of life to an

improved condition. This progress is not merely referring to economic growth

but also social, cultural, political, environmental as well as psychological

development (Bakar, Osman, Bachok, & Ibrahim, 2016). The Malaysian Quality

of Life (MQOL) (1999) stated that a QOL comprises the personal achievements, a

healthy lifestyle, access and freedom to pursue knowledge, and a standard of

living, “which surpasses the fulfilment of basic needs of individuals and their

psychological needs, to achieve a level of social well-being compatible with

the nation’s aspirations” (Harith & Noon, 2018, p. 4). There are 38

indicators representing ten components of QOL in Malaysia QOL Index (MQLI) 1999

(Bakar et al., 2016). The components are income and distribution, working life,

transport and communications, health, education, housing, environment, family

life, social participation and public safety (Bakar et al., 2016). However, the

appropriateness and consistency of the indicators and the components of MQLI

are questionable, and due to data constraint, the measure of MQLI at the state

level is not fully applicable (Bakar et al., 2016, p.133). Measuring QOL is

essential to understand people’s overall satisfaction with their existence. “It

involves measurement of quantified indicators and ‘materialistic’ aspects such

as income, expenses, assets and the ownership of goods and also

‘nonmaterialistic’ aspects such as health, social inclusion, education and

others” (Idris et al., 2016, p.2).

2.2 Pension scheme in

Malaysia

In general, the pension scheme is an

arrangement by which an employer and, usually an employee, pay into a fund that

is invested in providing the employee with a pension on retirement. The Public

Service Pension Scheme established under the Government Pension Ordinance of

1951 (revised Pension Act, 1980) provides pensions to civil servants. A

permanent government officer is eligible for a non-contributory government

pension that s/he is confirmed and has completed no less than three years of

recognised service. The scheme covers retirement benefits for officials in the

federal, state and local public service; employees of state enterprises, Judges

and members of Parliament. However, only pensionable officials qualify for

benefits under the scheme, while temporary and part-time officials were

excluded. The maximum monthly retirement pension available under the scheme is

50% of one’s final salary. Pensions for the federal civil servants are paid out

of the federal government general revenue. State enterprises, statutory

authorities and local governments contribute 17.5% of the employees’ monthly

salary in respect of their employees; the employees themselves do not

contribute anything (Doraisami, 2005).

The EPF, Malaysia, also provides

employment, injury and invalidity benefits under the Employees’ Social Security

Act 1969, called SOCSO. It consists of two separate schemes; the Employment

Injury Scheme (EIS) which was implemented in 1972, and the Invalidity Pension

Scheme (IPS) introduced in 1974. All employers employing one or more employees

are covered under the Act. The Act, however, applies only to those employees

earning less than RM2,000 (US$487.80) per month. Once an employee is covered,

then cover continues to be valid regardless of income. The main groups exempted

are domestic servants, casual workers, military and police personnel. The

contribution rate for the EIS is approximately 1.25% of wages and is wholly

paid by the employer. For the IPS, the rate of contribution is 1.0% of wages

shared equally between the employer and the employee (Doraisami, 2005).

The QOL depends on income, housing and

institutionalisation, family and community and health status of this elderly in

Malaysia (Ambigga, Ramli, Suthahar, Tauhid, Clearihan, & Browning, 2011).

Moreover, the emphasis on the pension scheme could be justified by fulfilling

the socio-economic well-being, including improving the health status of the

elderly in Malaysia (HelpAge International, 2006; Jamison, 2009). Retirement

earnings strategies must seek to decrease poverty among the elderly by securing

economic well-being in old age (Yusuf, 2012). Otherwise, pension assistances

risk being inadequate to provide these groups with an adequate income to live

their life in old age. The Civil Service Pension Scheme only covers workers in

public sectors, or around 11% of the elderly (Yusuf, 2012; Tey et al., 2016).

The pensioner’s health status and standard of living depend on good financial

conditions (Yusuf, 2012). Adequate pension assistance decreases the mental

anxiety for the elderly and improves their health and QOL (Tey et al., 2016).

3

Methodology

3.1 Research approach and research method

This study adopted a quantitative approach

via a social survey. This approach was used to gather data from a

representative sample that represents the broader population. It deals with

figures and proves relationships between independent and dependent variables

(Sekaran, 2006). It collects and analyses quantitative data to gain a better

understanding of the research problem (Creswell, 2005).

3.2 Sampling and sample size

A list of public pensioners was collected

from the Malaysian Government Pensioners Association Penang. A 95% confidence

level and 7% level of precision was used to calculate sample sizes (Yamane,

1967), and the minimum sample size for this study was 200 public pensioners.

This size of the sample was regarded as representative of the population.

A sample of 200 was drawn from a list of

9,000 public pensioners who are currently receiving pensions from the state of

Penang (Malaysian Government Pensioners Association Penang, 2017). The samples

were selected from members of the Malaysian Government Pensioners Association,

Penang. The list detailed the pensioners’ names and addresses, which helped the

researcher find the respondents and conduct interviews. The respondents were

aged 60 years, or older and random sampling was used for sample size selection,

in which the primary criterion for selection was that the respondents should be

public pensioners.

Table 1 presents the demographic and

socio-economic profile of the respondents. Data showed that 58% of the

pensioners were aged 60-65 years, 25% 66-70 years, 9% 71-75 years, 7% 76-80

years and the remaining 2% 80 years and above. In terms of gender, 73% were

male, and 28% female. Eighty-four percent of the respondents were married, 9%

single, 7% widow and 1% divorced. The highest 60% of the respondents had

secondary school education, 18% diploma, 13% primary, 7% degree and the

remaining 4% had a master’s degree. According to ethnicity, 66% were Malays,

24% Indian and 10% Chinese. This study found that the monthly income (before

retirement) of the 40% of the respondents had incomes between RM1000-3000

(US$241.14-US$731.70), 27% between RM3001-5000(US$731.95-US$1219.51), 27% less

than RM1000 (US$243.90), and the remaining 5% between RM5001-7000 (US$1219.75-

US$1707.31). On the other hand, after retirement, half of the population (50%)

had incomes of RM1000-3000 (US$241.14-US$731.70), 40% less than RM1000

(US$243.90) and the remaining 9% RM3001-5000 (US$731- US$1219.51). The majority

(45.5%) of the elderly received RM1000-3000 (US$241.14-US$731.70), 45% less than

RM1000 (US$243.90), and the remaining 10% between RM 3001-5000

(US$731.95-US$1219.51). In terms of additional income sources, 33% of the

elderly received financial assistance from their adult children, 31% had no

additional income sources. Other additional sources include 19% savings, 8%

paid work, 5% rental (house, land and shop) and 5% business.

Table 1. Percentage distribution of

selected demographic, socio-economic and health status of the study population

|

Variables

|

N (200)

|

Percent (100)

|

Variables

|

N (200)

|

Percent (100)

|

|

Age of the respondents

|

|

|

Monthly income

before retirement (RM)

|

|

|

|

60-65 Years

|

115

|

57.5

|

|

|

|

66-70 Years

|

50

|

25.0

|

Less than 1000

|

53

|

26.5

|

|

71-75 Years

|

18

|

09.0

|

1000-3000

|

80

|

40.0

|

|

76-80 Years

|

13

|

06.5

|

3001-5000

|

54

|

27.0

|

|

More than 80 Years

|

04

|

02.0

|

5001-7000

|

13

|

6.5

|

|

Gender of the respondents

|

|

|

Monthly income

after retirement (RM)

|

|

|

|

Male

|

145

|

72.5

|

Less than 1000

|

79

|

39.5

|

|

Female

|

55

|

27.5

|

1000-3000

|

100

|

50.0

|

|

Marital status

|

|

|

3001-5000

|

21

|

10.5

|

|

Married

|

168

|

84.0

|

Monthly pension

(RM)

|

|

|

|

Single

|

17

|

08.5

|

Less than 1000

|

89

|

44.5

|

|

Divorced

|

02

|

01.0

|

1000-3000

|

91

|

45.5

|

|

Widowed

|

13

|

06.5

|

3001-5000

|

20

|

10.0

|

|

Education qualification

|

|

|

Additional income

sources

|

|

|

|

Primary

|

26

|

13.0

|

Business

|

10

|

5.0

|

|

Secondary

|

119

|

59.5

|

Rent (land, house, shop)

|

09

|

4.5

|

|

Diploma

|

35

|

17.5

|

Contribution from

|

|

|

|

Degree

|

13

|

06.5

|

children

|

66

|

33.0

|

|

Masters

|

07

|

03.5

|

Savings

|

38

|

19.0

|

|

Ethnicity of the respondents

|

|

|

Paid work

|

16

|

8.0

|

|

Malay

|

132

|

66.0

|

No income sources

|

61

|

30.5

|

|

Indian

|

48

|

24.0

|

|

|

|

|

Chinese

|

20

|

10.0

|

|

|

|

|

Profession before retirement

|

|

|

|

|

|

|

Managerial

|

37

|

18.5

|

|

|

|

|

Administrative

|

21

|

10.5

|

|

|

|

|

Clerical

|

34

|

17.0

|

|

|

|

|

Teaching

|

31

|

15.5

|

|

|

|

|

Others

|

77

|

38.5

|

|

|

|

3.3 Data collection method(s) and data collection instruments

The quantitative data were collected

through a semi-structured face-to-face questionnaire. This study was conducted

from January 2017 to April 2017. The questions were administered in Malay and

English languages by a trained native speaker of each language. The first part

included questions on demographic and socio-economic variables such as age,

gender, ethnicity, religion, household income, expenditure, housing facilities,

self-rated health status, medical facilities, living cost, home, type of

accommodation, transportation, children`s education, the perception of pensions

scheme and recommendations to improve the QOL among pensioners in Malaysia. In

the second part, to determine the QOL, the study modified the QOL scale

developed by Zhao, Heath and Forgue (2005) and the QOL scale which is

consistent with the WHO QOL Index used in Western countries. To identify the

QOL, nine (9) items were used: Adequate benefit from a pension, satisfied with

present financial condition, the ability for savings money, the ability for

finance on children education, satisfied with current living places, and assets

is enough to manage an emergency. Each item is ranked on a 5-point Likert scale

(totally disagree-1, disagree-2, neutral-3, agree-4 and totally agree-5).

However, for two (2) items (bargaining during shopping to reduce prices and

difficulty facing for spending) reverse scoring was employed due to negative

items (totally agree-1, agree-2, neutral-3, disagree-4 and totally disagree-5).

The study calculated satisfaction with the pension (adequate benefit from

pension+ satisfied with present financial condition+ ability for savings money+

ability for finance on children education+ satisfied with current living places+

assets is enough to meet emergency+ good health status+ bargaining during

shopping to reduce prices+ difficulty facing for spending= satisfaction with

pension). The level of satisfaction for QOL is measured by a score of 33

representing low satisfaction, 34-66 medium satisfaction and 67-100 high

satisfaction. Higher scores indicate higher QOL. The convergent validity and

reliability were satisfactory. The Cronbach’s α coefficient of overall QOL

and most of its dimensions exceeded 0.71. The Cronbach’s a coefficient of the

QOL in this study was 0.776.

3.4 Data analysis

All data were analysed using SPSS (version

24.0). Descriptive statistics were employed to identify participant selected

demographic characteristics, socio-economic characteristics and health status

of the study population. A statistical analysis of custom table was used to get

the mean score of QOL, and Multinomial Logistic Regression (MLR) was used to

identify the relationship between the income of pensioners and QOL of the

elderly in Malaysia. The leading advantage of multinomial regression analysis

is the ability to estimate the predictive relationships of the outcome and

independent variables (Szaflarski, Hughe, Szaflarski, Ficker, Cahill, Li, &

Michael, 2003). The MLR analysis was applied since the dependent variable was

categorical. For some indicators, we used grouped data to identify the

intervals. When we used the grouped data for particular variables (for

instance, income), we considered them nominal/categorical variables. As a statistical

rule, analysing multiple categorical variables requires MLR analysis. Hence,

the MLR was used in this study. This MLR was used to identify the judges of

QOL, and P-values less than 0.05 were considered statistically significant.

3.5 Ethical consideration

Prior data collection, a confirmation

letter was issued by the School of Social Sciences, Universiti Sains Malaysia

(USM). The letter was submitted to the Honorary Secretary, Malaysian Government

Pensioners Association, Penang to secure their permission and cooperation to

collect preliminary information of pensioners. A presentation was conducted to

brief the secretary before the research was granted approval. A consent letter

for respondents was prepared and submitted before collecting the data.

4

Results

4.1 Living environment,

health and treatment-seeking behaviour of the elderly

In terms of present illness, Table 2 shows

that 25.5% of the elderly experience cardiovascular diseases, 25% diabetes, 24%

high blood pressure with cardiovascular diseases, 17% diabetes with high blood

pressure, 5% eye diseases with visual impairment and the remaining 5% have

mental health and depression. For healthcare, 81% of the beneficiaries received

healthcare from government hospitals, 11% from government clinic/medical centres

and 7% from private hospitals.

Table 2. Living environment and

health status of the elderly in Malaysia

|

Variables

|

N (200)

|

Percent (100)

|

|

Living environment

|

|

|

|

Bungalow

|

15

|

7.5

|

|

Semi- detached

|

14

|

7.0

|

|

Terrace

|

80

|

40.0

|

|

Kampong house (Malay traditional house)

|

43

|

21.5

|

|

Flat/Apartment

|

45

|

22.5

|

|

Condominium

|

03

|

1.5

|

|

Present illness

|

|

|

|

Diabetes with high blood pressure

|

33

|

16.5

|

|

High blood pressure with cardiovascular diseases

|

47

|

23.5

|

|

Diabetes

|

49

|

24.5

|

|

Eye diseases with visual impairment

|

10

|

5.0

|

|

Mental health and depression

|

10

|

5.0

|

|

Cardiovascular diseases

|

51

|

25.5

|

|

Getting healthcare

|

|

|

|

Government hospital

|

161

|

80.5

|

|

Private hospital

|

14

|

7.0

|

|

Government clinic /medical centre

|

21

|

10.5

|

|

Private clinic

|

04

|

2.0

|

4.2 Satisfaction level

of current pension scheme based on gender, marital status, ethnicity and income

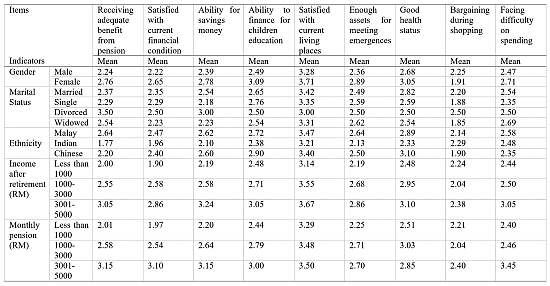

Table 3 shows that the mean (1-5) score of satisfaction on gender is

male 3.28 and female 3.71. This indicates that the satisfaction level of

current living place is near equal between male and female pensioners. The mean

score for good health status is male 2.68 and female 3.05, which indicates that

females are healthier than males. An interesting finding is that the mean score

for bargaining during shopping is male 2.25 and female 1.91, highlighting that

females bargain more when shopping. For facing difficulty during spending, the

mean score is male 2.47 and 2.71 female. This indicates that the satisfaction

levels of females are higher than male pensioners in the current pension

systems.

Analyses on the basis of ethnicity shows that the mean score of

adequate benefit from the pension scheme is 2.64 for Malay, Chinese 2.20 and

Indian 1.77. The findings highlight that most Indian pensioners feel that they

are not receiving enough benefits from the pension scheme. In terms of living

place, all the ethnicities are satisfied and the mean score of health status is

Chinese 3.10, Malay 2.89 and Indian 2.33. It establishes that the health

condition of the Chinese is better than other ethnicities. Pertaining to

bargain shopping, the mean score is Indian 2.29, Malay 2.14 and Chinese 1.90.

The findings indicate that Chinese bargain more when shopping compared to the

other ethnicities. A significant finding is that Indians are more dissatisfied

with their current pension scheme than Malays and Chinese.

For the results based on marital status, the mean score of ability to

saving money is 3.00 for the divorced, married 2.54, widows 2.23 and single

2.18 indicating that only divorced pension holders can save money. For

bargaining while shopping, the mean score for divorced is 2.50, married 2.20,

single 1.88 and widowed 1.85. It shows that the single and widowed group

bargain more while shopping compared to married and divorced cohorts. The mean

for satisfied with current living places is higher than the average of 2.58,

meaning they are happy with current living places. An interesting fact is that

the majority of scores for all items is less than the average mean of 2.58.

The results of satisfaction of pensioners based on income group after

retirement reported that the mean score of receiving adequate benefits from the

current pension system for the income group of RM3001-5000

(US$731.95-US$1219.51) is 3.05; 2.55 for those with incomes between RM1000-3000

(US$241.14-US$731.70); and 2.00 for the income group earning less than RM1000

(US$243.90). The income group earning less than RM1000 (US$243.90) indicates

that they are not satisfied with the current pension systems. The mean score of

satisfaction with the current financial condition for the income group

RM3001-5000 (US$731.95-US$1219.51) is 2.86, 2.58 for RM1000-3000

(US$241.14-US$731.70), and mean score 1.90 for the income group earning less

than RM1000 (US$243.90). Additionally, the mean score of receiving adequate

benefits from the current pension system for the income group of RM3001-5000

(US$731.95-US$1219.51) is 3.15, mean score 2.58 for income group RM1000-3000

(US$241.14-US$731.70), and 2.01 for the income group earning less than RM1000

(US$243.90). The mean score of satisfaction with the current financial

condition for the income group RM3001-5000 (US$731.95-US$1219.51) is 3.10, 2.54

for RM1000-3000 (US$241.14-US$731.70), and 1.97 for the income group earning

less than RM1000 (US$243.90). The mean score of good health status for the

income group RM1000-3000 (US$241.14-US$731.70) is 3.03, 2.85 for income

RM3001-5000 (US$731.95-US$1219.51), and the income group earning less than

RM1000 (US$243.90) acquired the mean of 2.51. The findings highlight that the

health status is good for the income group of RM1000-3000 (US$241.14-US$731.70)

compared to other groups. All of the groups are happier with their current

living places. The findings showed that the lower-earning income group is less

satisfied than those earning more. It can be summarised that financial

assistance can significantly help to improve the QOL of pensioners in Malaysia.

4.3 Level of

satisfaction for QOL of pensioners

Table 4 shows that the average mean score

for QOL is 2.58 (SD.694), indicating the QOL is below the standard of the

public pensioners in Malaysia. The maximum and minimum mean scores value for

QOL are (lowest score 1- highest score 5) 4.33 and 1.33 respectively.

Table 4. The mean of satisfaction

for QOL of pensioners in Malaysia

|

N

|

Valid

|

200

|

|

Missing

|

00

|

|

Mean

|

2.5833

|

|

Standard Deviation

|

0.69472

|

|

Range

|

3.00

|

|

Minimum

|

1.33

|

|

Maximum

|

4.33

|

In Table 5, when we consider the overall

level of QOL in terms of gender identity, approximately 51% female and 27% of

males are highly satisfied. It seems that females are more satisfied than

males. If we do not disaggregate gender, there is no meaningful difference in

the satisfaction levels. However, with the gender-disaggregated analysis, we

find that females have better satisfaction levels than males.

Table 5. Level of satisfaction for

QOL in Malaysia

|

Gender

|

Low

|

Medium

|

High

|

|

Male

|

56 (38.6%)

|

50 (34.50%)

|

39 (26.9%)

|

|

Female

|

12 (21.8%)

|

15 (27.3%)

|

28 (50.9%)

|

|

Total

|

68 (34.0%)

|

65 (32.5%)

|

67 (33.5%)

|

4.4 Relationship of

satisfaction level for QOL based on income and sex

Table 6 shows that the MLR estimates found

that when we considered low-level satisfaction as a reference category, the

odds ratio (exp (B)) of males is 0.714 times likely to be adequately satisfied

where the p-value is 0.438 (P>0.05) with no significance. Moreover, when we

consider low satisfaction as a reference category, we found that the odds ratio

(exp (B)) for males is 0.298 times likely to be more satisfied where the

p-value is 0.003 (P<0.05) with significance. In terms of financial

conditions, there is no significant differences in their satisfaction level,

providing a significant odds ratio (exp (B)) of 0.158 with p-value 0.004

(P<0.05). In summary, there is no significant relationship between income

after retirement and income from pension scheme with the satisfaction level for

QOL among public pensioners in Malaysia. However, in terms of gender, the

satisfaction levels of females are higher than the satisfaction levels of

males.

Table 6. Relationship of

satisfaction level for QOL based on income and sex: Multinomial logistic

regression estimates

|

Satisfaction level for QOL

|

|

B

|

Std. Error

|

Wald

|

Df

|

Sig.

|

Exp (B)

|

|

Medium

|

Intercept

|

.000

|

.707

|

.000

|

1

|

1.000

|

|

|

Monthly pension (RM) less than 1000

|

-.141

|

.746

|

.036

|

1

|

.850

|

.868

|

|

RM1000-3000

|

.074

|

.758

|

.010

|

1

|

.922

|

1.077

|

|

RM3001-5000

|

0b

|

.

|

.

|

0

|

.

|

.

|

|

High

|

Intercept

|

1.099

|

.577

|

3.621

|

1

|

.057

|

|

|

Monthly pension (RM) less than 1000

|

-1.846

|

.644

|

8.206

|

1

|

.004

|

.158

|

|

RM1000-3000

|

-.746

|

.632

|

1.395

|

1

|

.238

|

.474

|

|

RM3001-5000

|

0b

|

.

|

.

|

0

|

.

|

.

|

|

Medium

|

Intercept

|

.223

|

.671

|

.111

|

1

|

.739

|

|

|

Income after pension (RM) less than 1000

|

-.348

|

.716

|

.237

|

1

|

.627

|

.706

|

|

RM1000-3000

|

-.223

|

.719

|

.096

|

1

|

.756

|

.800

|

|

RM3001 -5000

|

0b

|

.

|

.

|

0

|

.

|

.

|

|

High

|

Intercept

|

1.099

|

.577

|

3.621

|

1

|

.057

|

|

|

Income after pension (RM) less than 1000

|

-1.917

|

.655

|

8.557

|

1

|

.003

|

.147

|

|

RM1000-3000

|

-.811

|

.626

|

1.679

|

1

|

.195

|

.444

|

|

RM3001-5000

|

0b

|

.

|

.

|

0

|

.

|

.

|

|

Medium

|

Intercept

|

.223

|

.387

|

.332

|

1

|

.565

|

|

|

Male

|

-.336

|

.433

|

.603

|

1

|

.438

|

.714

|

|

Female

|

0b

|

.

|

.

|

0

|

.

|

.

|

|

High

|

Intercept

|

.847

|

.345

|

6.030

|

1

|

.014

|

|

|

Male

|

-1.209

|

.403

|

8.994

|

1

|

.003

|

.298

|

|

Female

|

0b

|

.

|

.

|

0

|

.

|

.

|

Furthermore, Table 7 found concerning

recommendations to improve QOL, that 51% of the elderly mentioned that the

government should increase the pension assistance, 21% indicated social safety

nets, 14% introduce pensions in the private sector, 9% free healthcare and the

remaining 7% suggested creating new employment opportunity for the elderly to

generate income.

Table 7. Recommendations for

improving QOL of elderly in Malaysia

|

Recommendations by pensioners to improve QOL

|

N (200)

|

Percent (100)

|

|

Increased amount and benefit of pension assistance

|

101

|

50.5

|

|

Introduce social safety nets for all citizens

|

41

|

20.5

|

|

Provided free healthcare of the elderly by the

government

|

18

|

9.0

|

|

Introduce pension schemes in the private sector

|

27

|

13.5

|

|

Employment opportunity for older for income

generation

|

13

|

6.5

|

5

Discussion

The objective of this study was to examine

the public pension scheme and QOL of the elderly in Malaysia. The results

showed that the highest 40% of the pensioners lived in the terrace house, and

81% took medical support from the government general hospital. The mean score

on the satisfaction level was male 3.28 and female 3.71, whereas the mean score

of adequate benefit from the pension scheme was 2.64 Malay, 2.20 Chinese and

1.77 Indian. According to the living places, the mean score is 3.47 for Malay;

3.40 Chinese; and 3.21 Indian. In terms of health index, the mean score of the

health status of Chinese was 3.10, Malay 2.89 and Indian 2.33. The mean scores

on the ability for savings money were highest among the divorced with 3.00,

2.54 married 2.54, 2.23 widows and 2.18 single. The overall satisfaction level

among the pensioners is 34% low, 34% high and the 33% medium. Finally, 51% of

the pensioners mentioned that the government should increase the amount of

pension assistance.

Results of the study showed that the

average mean score for QOL is 2.58 (SD.694) indicating the QOL is below the

standard expected by the public pensioners in Malaysia. The insecurity of

income among pensioners could be low due to low education, low pay and low

skills with high life expectancy (Yusuf, 2012). This study found that education

level and employment rate, occupation and marital status influence the

socio-economic conditions of the elderly in Malaysia. The education

qualification affects the pension contributions after retirement, with highly

educated people tending to receive higher salaries than increase savings after

retirement (Ju et al., 2017; Yusuf, 2012).

This study revealed that the income of the

elderly was very low, with no significant difference between the income before

and after retirement. The analysis of this study confirms that the mean score

for QOL is 2.58, and income from a pension was not significantly related to QOL

(Ng & Hamid, 2013). Our findings corroborate past findings on the elderly

in Malaysia with low-income earners more vulnerable than higher-income groups

(Lloyd-Sherlock & Agrawal, 2014; Tey et al., 2016). Borg et al. (2008)

established a significant relationship between income and the QOL of the

elderly. The most important sources of social income for the elderly were from

their adult children. However, the extended family system is being changed to a

nuclear family system, certainly distressing and putting tension on the family

as the elderly assuming the role of the caregiver (Hew, 2007; Ng, Lim, Jin,

& Shinfuku, 2005; Selvaratnam & Tin, 2007). Support from children and

income from savings, rental and pensions were often insufficient to meet the

needs of pensioners and maintain their QOL (Tolos, 2012). The life expectancy

is high in Malaysia and higher longevity means that the elderly require higher

levels of savings to maintain their living standards (Yusuf, 2012).

Additionally, the savings do not ensure

the elderly are safe from poverty after retirement (Vaghefi, Kari, & Talib,

2016). The high cost of living and increasing prices of goods, services and

utilities pose a challenge to maintaining QOL in Malaysia. Most people expect

that economic problems can be managed through enhanced pension systems (Samad

& Mansor, 2013).

Malaysia is a multi-ethnic country

comprising three ethnic groups, namely Malays, Chinese and Indians. Based on

ethnicity, the findings highlight that the mean score of adequate benefit from

the pension scheme is 2.64 for Malay, Chinese 2.20 and Indian 1.77. The study

indicated that Indians feel that they are not benefiting enough from their

pensions. Malaysia is facing socio-demographic challenges and changes due to a

rapidly ageing population and the industrial revolution. It may be one of the

reasons that Malaysians are facing challenges. Further, socio-economic factors

and cultural results in different ethnic groupings in terms of rural–urban

distribution and profession (Tey et al., 2016). In terms of health, the mean

score of health status is 3.10 for the Chinese, Malay 2.89 and Indian 2.33. It

established that the health condition of Chinese pensioners is better than

other ethnicities. It could be explained by Chinese being generally more

educated, observe healthier diets, are hardworking, tend to have smaller

families, and observe positive healthcare practices (Tey et al., 2016).

Currently, the elderly are not increasing

only in numbers. They are also experiencing increased rates of Non-Communicable

Diseases (NCD) (Ambigga et al., 2011). The NCD, including diabetes, hypertension,

heart disease, especially among the elderly, is increasing (Anderson &

Phillips, 2006). Currently, one-third to one-fifth of the elderly are facing

heart diseases, diabetes, high blood pressure, and diabetes with high blood

pressure. This finding is consistent with Ambigga et al. (2011), Rechel et al.

(2013), Rowe (2015), and Tey et al. (2017). Mental health problems and visual

impairment and blindness are also prominent among the elderly in Malaysia

(Ambigga et al., 2011; Rechel et al., 2013). The prevalence of depression among

the elderly is also higher (18%) due to financial hardship (Ambigga et al.,

2011). Improved longer life expectancy indicates vulnerability to diseases and

infirmities, resulting in greater healthcare cost and makes caring for the elderly

more challenging. It means that elderly people may suffer from ailments that

require regular treatment (Yahaya et al., 2010). The lack of widespread health

insurance system has caused economic suffering among the elderly who have to

pay excessive healthcare costs. In addition, the elderly might isolate from

relations or neighbours and find it hard to manage complications such as

accidents, disasters and acute diseases. The elderly with health problems and

disabilities typically require dependent living (Yahaya et al., 2010).

Additionally, the expansion of services for the elderly in Malaysian healthcare

is slow despite the need for long-term management of this cohort (Ambigga et

al., 2011). It indicates that the social security system in Malaysia is insufficient

(Masud, Haron, & Gikonyo, 2008). Given the above, while there is a robust

innate judgement that pension schemes should improve the elderly’s health

status, this result is dependent on several factors (Lloyd-Sherlock &

Agrawal, 2014).

Housing is essential for human welfare.

This study concluded that pensioners in Malaysia are highly satisfied with QOL

in terms of housing (Karim, 2012; Ramli et al., 2013). One reason is due to the

Malaysian government’s continuous efforts to ensure that all Malaysians,

especially the low and middle-income groups, have the opportunity to buy houses

by establishing affordable-housing programmes such as Programme Perumahan

Rakyat (people’s housing), Rumah Mampu Milik

(affordable home) and Rumah Mesra Rakyat (friendly homes). These programmes

allow low-income households the opportunity to buy low-cost housing with access

to electricity and water. This finding is consistent with Karim (2012) and

Ramli et al. (2013). Moreover, the satisfaction level of current living places

is higher due to the provision for an early pension to finance the purchase of

housing which has resulted in a greater proportion of Malaysian citizens owning

homes. The provision to withdraw pensions early has had a significant impact on

homeownership, and older Malays have benefitted from rent-free living after

retirement (Doling & Omar, 2012).

The study established that females (51%)

had a significantly higher QOL with a P-value of .003 (P<0.05) compared to

males. For example, it would be interesting to learn more about the gender gap

in terms of satisfaction. This could be because the perception of males for

satisfaction level with a pension was more negative than females (Onunkwor et

al., 2016). Studies indicated lower QOL among males and attributed their

findings to feelings of unpleasantness among elderly males due to low

confidence and negative observations of pensions among the elderly in Malaysia

(Pereira et al., 2006; Vitorino, Paskulin, & Vianna, 2012). This research

generated evidence that the public pension scheme in Malaysia is insufficient

to maintain the QOL. The findings of this study will enhance the development of

the practitioners’ capacity to formulate stronger policies and planning to

improve the QOL for the elderly in Malaysia.

6

Limitations of the study

This study has several limitations. The

first limitation was that the participants were limited to 200 and not

nationally representative, as only public pensioners in Penang were included.

Thus, the findings cannot be implicated to the entire Malaysia. It is crucial

to research diverse perceptions in order to obtain authentic data to guide the

framing of robust policies, legislation, and approaches to cater to the needs

of the elderly in Malaysia. Hence, we encourage others to investigate our

findings to include more diverse and a larger sample size of pensioners in

Malaysia. The second limitation concerns the measurement of the QOL Index.

There is still a lack of consensus among researchers about its definition

reflected in the choice of items for QOL measurement. A common protocol and

fully structured design were not possible for QOL indicators due to lack of

relevant national data and limited resources for research in a developing

country like Malaysia (Skevington, Lotfy, & O’Connell, 2004). Des being the

lack of an agreed definition or standard form of measurement for QOL in

Malaysia, this study used a set of characteristics to measure the QOL which is

consistent with Zhao, Heath and Forgue (2005) and the Western society as the WHO

used the measurements of physical health, psychological health, social

relations and environment (Gou, Xie, Lu, & Khoshbakh, 2018).

7

Conclusions and policy implications

The study provided insightful findings

into the pension scheme in Malaysia. It highlighted several indicators of the

QOL components and provided the current status on those indicators for

pensioners. We acknowledge that this study could not provide sufficient

explanation about the variation of the mean scores on different components

across gender, ethnicity, marital status, age, education level, and other

segregations. We suggest further comparative study that explains these

variations further. Despite these limitations, we believe that this study

explored important issues concerning the living condition, marital status,

ethnicity, income, health facilities and overall satisfaction level of the

services on the QOL Index. The findings will be a useful guideline to

policymakers to formulate policy, particularly to review the retirement age due

to higher longevity and government intervention to enhance elderly care

facilities (Yusuf, 2012; Ali, & Hatta, 2014). Formulating an overarching

policy on social protection, for example, to formulate legislation is essential

to improve the QOL of the elderly. This study offers a useful guideline to

maintain a standard of living of the elderly (Tey et al., 2016).

The findings are also significant for

development practitioners such as non-governmental organisations (NGOs) workers

and human rights workers in Malaysia to understand the present status of the

pensioners and their problems. This is imperative for the elderly, particularly

their rights and well-being as key for development practitioners. Moreover,

there is limited evidence in Malaysia about the lives and livelihoods of the

elderly and their QOL.

A growing body of literature indicates

that social work plays a significant role in improving the elderly’s’ lives and

livelihoods (Ali, Hatta, & Azman, 2014). The scope, role and contribution

of social work include improving the elderly’s hazardous conditions and poverty

(Kerr, Gordon, MacDonald, & Stalker, 2005); marital problems, financial

stress, or chronic illness by using QOL scales (Lautar, 2015); assessment of

the needs of elderly, older care planning and counselling for better QOL (Kerr

et al., 2005); the betterment of the elderly’s economical, physical, and

psychological problems (Samad & Mansor, 2013); discrimination and social

exclusion of elderly (Ali & Hatta, 2010); the well-being of the elderly in

Malaysia (Lloyd-Sherlock & Agrawal, 2014); improving their QOL (Ambigga et

al., 2011); and illness and social security schemes (public and private) (Tey

et al., 2016). Finally, the findings of our paper support empowering the

elderly and their caregivers with skills, knowledge and positive attitudes

towards caring for the elderly (Ambigga et al., 2011).

References

Ali, I.,

& Hatta, Z. A. (2010). Microfinance and

poverty alleviation in Bangladesh: Perspective from social work. The Hong Kong Journal of Social Work, 44(2), 121-134.

Ali, I.,

Hatta, Z. A., & Azman, A. (2014).

Transforming the local capacity on natural disaster risk reduction in

Bangladeshi communities: A social work perspective. Asian

Social Work and Policy Review, 8(1), 34-42.

Ali, I.,

& Hatta, Z. (2014). Zakat

as a poverty reduction mechanism among Muslim community: Case study of Bangladesh, Malaysia and

Indonesia. Asian Social Work and Policy Review, 8(1),

59-70.

Ambigga,

K.S., Ramli, A.S., Suthahar, A., Tauhid, N., Clearihan, L., & Browning, C. (2011). Bridging the gap in ageing: Translating policies into

practice in Malaysian Primary Care. Asia Pacific Family Medicine, 10(2),

1-7.

Anderson,

B. A., & Phillips, H. E. (2006). Adult mortality (age 15‐64) based on death notification

data in South Africa: 1997‐2004. Pretoria: Statistics South

Africa.

Alavi et

al. (2011). Exploring the meaning of ageing and

quality of life for the suburban older people. Pertanika Journal of Social Sciences and Humanities, 19(S), 41-48.

Bakar,

A. A., Osman, M.M., Bachok, S., & Ibrahim, M. (2016). Investigating rationales of Malaysia quality of life and

wellbeing components and indicators. Procedia - Social

and Behavioral Sciences, 222, 132-142.

Barrientos,

A. (2009). New strategies for old-age income

security in developing countries. In S. Bhaskaran & G. Sushuma (Eds.), In financial inclusion for the aged: Issues and strategies.

Hyderabad: ICFAI University Press.

Barr,

N., & Diamond, P. (2009). Reforming

pensions: Principles, analytical errors and policy directions. International Social Security Review, 62(1), 5-29.

Borg,

C., Fagerstrom, C., Balducci, C., Burholt, V., Ferring, D., Weber, G., Wenger, C., Holst, G., & Hallberg, I.R. (2008). Life satisfaction in 6 European

countries: The relationship to health, self-esteem, and social and financial

resources among people (aged 65-89) with reduced functional capacity. Geriatric Nursing, 29(1), 48-57.

Bodur,

S., & Cingil, D. D. (2009). Using WHOQOL-BREF to evaluate quality of life among Turkish elders

in different residential envıronments. The Journal

of Nutrition, Health and Aging, 13(7), 652-656.

Chan

Y.K., Andy Kwan C.C., & Daniel Shek T. L.

(2005). Quality of Life in Hong Kong: The CUHK Hong Kong Quality of Life Index.

In D.T. Shek, Y.K. Chan & P.S. Lee (Eds.), Quality-of-Life

research in Chinese, Western and Global contexts (pp. 259-289).

Social Indicators Research Series, 25. Springer, Dordrecht: Netherlands.

Chen,

Y., Hicks, A., & While, A. E. (2014).

Quality of life and related factors: A questionnaire survey of older people

living alone in Mainland China. Quality of Life

Research, 23(5), 1593-1602.

Creswell,

J. W. (2005). Educational

research: Planning, conducting, and evaluating quantitative and qualitative

approaches to research (2nd ed.). Upper Saddle River, NJ:

Merrill/Pearson Education.

Cummins,

R. A. (1997). Comprehensive quality of life

scale–school version (Grades 7-12) (5th ed.). School of Psychology Deakin

University, Melbourne: Australia.

Department

of Statistics Malaysia. (2017). Current

population estimates, Malaysia, 2016-2017. Retrieved August 10, 2019, from https://www.dosm.gov.my/v1/index.php?r=column/pdfPrevandid=a1d1UTFZazd5ajJRWFHNDduOXFFQT09

Doling,

J., & Omar, R. (2012). Home ownership and

pensions in East Asia: The case of Malaysia. Population

Ageing, 5(1), 67-85.

Doraisami,

A. (2005). The gender implication

of microeconomic policy in performance in Malaysia. United Nations

Research Institute for Social Development. Retrieved May, 3, 2019, from http://www.unrisd.org/80256B3C005BCCF9/search/1A294D473D496D48C1256FF6 00504F12

Gou, Z., Xie, X., Lu, Y.,

& Khoshbakh, M. (2018). Quality of Life (QoL)

survey in Hong Kong: Understanding the importance of housing environment and

needs of residents from different housing sectors. International

Journal of Environment Research and Public, 15(2),

219-234.

Hai. (2009). Help age international-age help.

Retrieved October 10, 2018, from www.helpage.org

Harith,

N, H. M., & Noon, H. M. (2018). Determinants

of subjective well-being: Perspectives of Malay Muslims. Journal of Administrative Science Special Edition: ICOPS, JAS,

15(3), 1-12.

Hatta,

Z., & Ali, I. (2013). Poverty reduction

policies in Malaysia: Trends, strategies and challenges. Asian Culture and

History, 5(2), 48-56.

Haron,

S. A., Yahya, N., Paim, L., Tengku, A., Hamid, T. A., Zainalaludin, Z.,

Ridzuan, M., Syed, A. R. S. N., & Abu Samah, A. (2006). Living arrangements of older persons on welfare:

Implications on health, economic wellbeing and life satisfaction. Asia Pacific Journal of Public Health, 18(suppl.),

26-34.

Hew, C.

S. (2007). Like a chicken standing on one leg.

Urbanization and single mother. In: C. S. Hew (Ed.), Village

mothers, city daughters: Women and urbanization in Sarawak (pp.104-119).

Singapore: Institute of Southeast Asian Studies.

Help Age

International (2006). Why

social pensions are needed now? Retrieved January 1, 2020, from http://www.helpage.org/download/4c48d8bb4513c/.

Idris,

K., Shaffril., M. H. A., Yassin, S. M., Samah, A.A., Hamzah, A., & Samah,

B.A. (2016). Quality of Life in rural

communities: Residents living near to Tembeling, Pahang and Muar Rivers,

Malaysia. PLoSONE, 11(3), 1-16.

Jamison,

D. (2009). Cost-effectiveness analysis: Concepts

and application. In R. Detels, R.Beaglehole, M. Lansang, & M. Gulliford

(Eds.), Oxford textbook of public health (5th

ed.), (pp.903-919). Oxford: Oxford University Press.

Ju, Y.

J., Han, K.T., Lee, H. J., Lee, E., Choi, J.W., Hyun, I.S., & Park, E.C. (2017). Quality of life and national pension receipt after

retirement among older adults. Geriatrics Gerontology

International, 17(8), 1205-1213.

Karim,

N. A. (2012). Low cost housing environment:

Compromising quality of life. Proccedia—Social and

Behavioral Science, 35(1), 44-53.

Kerr,

B., Gordon, J., MacDonald, C., & Stalker, K. (2005). Effective social work with older people. Retrieved May 13, 2020

from http://www.21csocialwork.org.uk/.

Lautar, C. J. (2015). Quality of life

indicators and their impacts on social work practice. Egyptian Journal of Social Work (EJSW), 1(1), 19-30.

Lim, C.

K. (2012). The changing

needs of older Malaysians: A Selangor case study. Published

thesis, Department of Geography, Environment and Population, Faculty of

Humanities and Social Sciences, The University of Adelaide. Australia.

Lloyd-Sherlock,

P., & Agrawal, S. (2014). Pensions and the

health of older people in South Africa: Is there an effect? The Journal of Development Studies, 50(11), 1570-1586.

Marans,

R.W. (2015). Quality of urban life &

environmental sustainability studies: Future linkage opportunities. Habitat International, 45(1), 47-52.

Masud,

J., Haron, S. A., & Hamid, T. A. (2006a).

Perceived income adequacy and health status among older persons in Malaysia. Asia Pacific Journal of Public Health, 18(suppl), 2-8.

Masud,

J., Haron, S. A., Hamid, T. A., & Zainaludin, Z. (2006b). Economic wellbeing of the elderly: Gender differences. Consumer Interest Annual, 56, 426-431.

Masud,

J., & Harun, S.A. (2008). Income difference

among elderly in Malaysia: A regional comparison. International

Journal of Consumer Studies, 32(4), 335-340.

Masud,

J., Haron, S. A., & Gikonyo, L.W. (2008). Gender

Differences in income sources of the elderly in Peninsular Malaysia. Journal of Family and Economic Issue, 29(4),

623-633.

Mohd,

S., Mansor, N., Awang, H., & Ahmad, S.K.

(2015). Population ageing, poverty and social pension in Malaysia. In T. N.

Peng, C. K. Cheok, & R. Rasiah (Eds.), Revisiting

Malaysia’s population–development nexus the past in its future (pp.155-174).

Faculty of Economics and Administration (FEA), University of Malaya, Kuala

Lumpur: Malaysia.

National

Economic Advisory Council (NEAC). (2010). New economic model for Malaysia. Putrajaya: NEAC,

Malaysia.

Ng, S,

T., & Hamid, T. A. (2013). Effects of work

participation, intergenerational transfers and savings on life satisfaction of

older Malaysians. Australasian Journal on Ageing 32(4):

217–221.

Ng, T.

P., Lim, L. C. C., Jin, A., & Shinfuku, N.

(2005). Ethnic differences in quality of life in adolescence among Chinese,

Malay and Indian in Singapore. Quality of Life Research:

An International Journal of Quality of Life Aspect of Treatment, Care and

Rehabilitation, 14(7), 1755-1768.

Onunkwor,

O. F., Al-Dubai, S. A. R., George, P. P., Arokiasamy, J., Yadav, H., Barua, A.,

& Shuaibu, H. O. (2016). A cross-sectional

study on quality of life among the elderly in non-governmental organizations’

elderly homes in Kuala-Lumpur. Health and Quality of

Life Outcomes, 14(6), 1-10.

Ong, F. S.,

& Hamid, T. A. (2010). Social protection in

Malaysia – current state and challenges towards practical and sustainable

social protection in East Asia: A compassionate community. In M.G. Asher, S.

Oum, & F. Parulian (Eds.), Social protection in East

Asia – current state and challenges (pp. 182-219). ERIA Research Project

Report 2009-9, Jakarta: ERIA.

Park,

D., & Estrada, G. (2012). Developing Asia’s pension systems and old age income support.

ADBI Working Paper 358. Asian Development Bank Institute, Tokyo:

Japan. Retrieved August 9, 2018, from http://www.adbi.org/working-paper/2012/04/26/5056.dev.asia.pension.systems/

Pereira,

R. J., Cotta, R.M.M., Franceschini, S. D. C.C., Ribeiro, R. D. C. L., Sampaio,

R.F., Priore, S.E., & Cecon, P.R. (2006).

Contribution of the physical, social, psychological and environmental domains

to overall quality of life of the elderly. Revista de Psiquiatria do Rio

Grande do Sul, 28(1), 1-28.

Ramli

S.A., Yassin, S.M., Idris, K., Hamzah, A., Abu, S.B., & Samah, A, A, et al. (2013). The quality of life of Bahau riverside community: The case

of the rural community living along Muar and Serting Rivers. International Journal of Business Management, 7(2),114-120.

Rechel,

B., Grundy, E., Robine, J. M., Cylus, J., Mackenbach, J. P., Knai, C., &

McKee, M. (2013). Ageing in the European Union. The Lancet, 381(9874), 1312–1322.

Rowe, J.

W. (2015). Successful aging of societies. Journal of the American Academy of Arts and Sciences

(Dædalus), 144, 5-12.

Samad,

S.A., & Mansor, N. (2013). Population ageing

and social protection in Malaysia. Malaysia Journal of Economic Studies, 50(2), 139-156.

Sekaran,

U. (2006). Research

methods for business a skill building approach (4th ed.). John Wiley

& Sons, New Delhi: India.

Sharifah,

A. H., Sharpe, D. L. Masud, J., & Abdel-Ghany, M. (2010). Health divide: Economic and demographic factors associated

with self-reported health among older Malaysians. Journal of Family and Economic Issues, 31(3), 328-337.

Schatz,

E., Gómez-Olivé, X., Ralston, M., Menken, J., & Tollman, S. (2011). Gender, pensions, and social wellbeing in

rural South Africa. Working Paper. Institute of Behavioral

Science: University of Colorado Boulder. USA.

Schalock,

R. L. (2004). The concept of quality of life:

What we know and do not know. Journal of Intellectual

Disability Research, 48(3), 203-216.

Selvaratnam,

D. P., & Tin, P. B. (2007). Lifestyle of the

elderly in rural and urban Malaysia. Annals of the New

York Academy of Sciences, 1114(1), 317-325.

Skevington,

S.M., Lotfy, M., O’Connell, K.A., & WHOQOL Group. (2004). The World Health Organization’s WHOQOL-BREF quality of life

assessment: Psychometric properties and results of the international field

trial a report from the WHOQOL Group. Quality of Life

Research, 13(2), 299-310.

Smith,

A. E., Sim, J., Scharf, T., & Phillipson, C.

(2004). Determinants of quality oflife amongst older people in deprived

neighbourhoods. Ageing and Society, 24(5), 793-814.

Schatz,

E., Gómez-Olivé, X., Ralston, M., Menken, J., & Tollman, S. (2012). The impact of pensions on health and wellbeing in rural

South Africa: Does gender matter? Social Science and

Medicine, 75(10), 1864-1873.

Szaflarski,

J.P., Hughe, C., Szaflarski, M., Ficker, D.M., Cahill, W.T., Li, M., &

Michael, D. P.

(2003). Quality of life in psychogenic nonepileptic seizures. Epilepsia, 44(2), 236-242.

Tey, N.

P., Siraj, S. B., Kamaruzzaman, S. B.B., Chin, A.V., Tan, M. P., Sinnappan, G.

S., & Müller, A. M. (2016). Aging in

multi-ethnic Malaysia. Gerontologist,

56(4), 603-609.

The

WHOQOL Group (1998). The world health

organization quality of life assessment (WHOQOL): Development and general

psychometric properties. Social Science and Medicine, 46,

1569-1585.

Vaghefi,

N., Kari, F., & Talib, M. A. (2016). Poverty and income replacement profile among EPF retiree in

Malaysia. Retrieved October 10, 2018, from https://umexpert.um.edu.my/file/publication/00001633_136274_69413.pdf

Vitorino,

L., Paskulin, L., & Vianna L. (2012).

Quality of life among older adults resident in long-stay care facilities. Latin America Journal of Nursing, 20(6),

1186-1195.

Veenhoven,

R. (2007). Subjective measures of well-being. In

M. McGillivray (Eds.), In human well-being: Concept and

measurement (pp. 214-239). Palgrave Macmillan: London, UK.

Wan-Ibrahim,

W.A., & Zainab, I. (2014). Some demographic aspects of population aging in Malaysia. World Applied Sciences Journal, 30(7), 891-894.

Yahaya,

N., Abdullah, S.S., Momtaz, Y. A., & Hamid, T. A. (2010). Quality of life of older Malaysians

living alone. Educational Gerontology, 36(10-11), 893-906.

Yamane,

T. (1967). Statistics, an

introductory analysis (2nd ed.). New York, NY: Harper and Row.

Yusuf,

M. M. (2012). Women and

pensions in Malaysia: Assessing the impacts of disruptions in working life. PhD

thesis and published by University of Southampton, UK.

Yusoff,

S. N., & Zulkifli, Z. (2014). Rethinking of

old age: The emerging challenge for Malaysia. International

Proceedings of Economics Development and Research (IPEDR), 71(13),

69-73.

Zhao,

B., Heath, C. J., & Forgue, R. E. (2005).

Quality of life and use of human services among households. Consumer Interest Annual, 51(1), 83-106.

Author´s

Address:

Isahaque Ali, PhD, PDF,

Social Work Section, School of Social Sciences, Universiti

Sains Malaysia

11800 Penang, Malaysia

+604-653-3369

ialisw@yahoo.com

Author´s

Address:

Azlinda Azman, PhD

Social Work Section, School of Social Sciences, Universiti

Sains Malaysia,

11800 Penang, Malaysia.

+604-653-3369

azlindaa@usm.my

Author´s

Address:

Zulkarnain A. Hatta, DSW

Faculty of Social Science, Arts & Humanities, Lincoln University College

47301, Petaling Jaya, Selangor, Malaysia

+60195715038

zulkarnain@lincoln.edu.my

Author´s

Address:

M. Rezaul Islam, PhD

1000, Bangladesh

+8801763983451

rezauldu@gmail.com

Author´s

Address:

A H M Belayeth Hussain, PhD, PDF

Center for Research on Women & Gender (KANITA), Universiti Sains

Malaysia (USM), Malaysia

+60147454241

belayeth@usm.my

![]()

![]()